The Consumer Duty: is this a paradigm shift in consumer protection?

Some thoughts from a few of us…

First some background

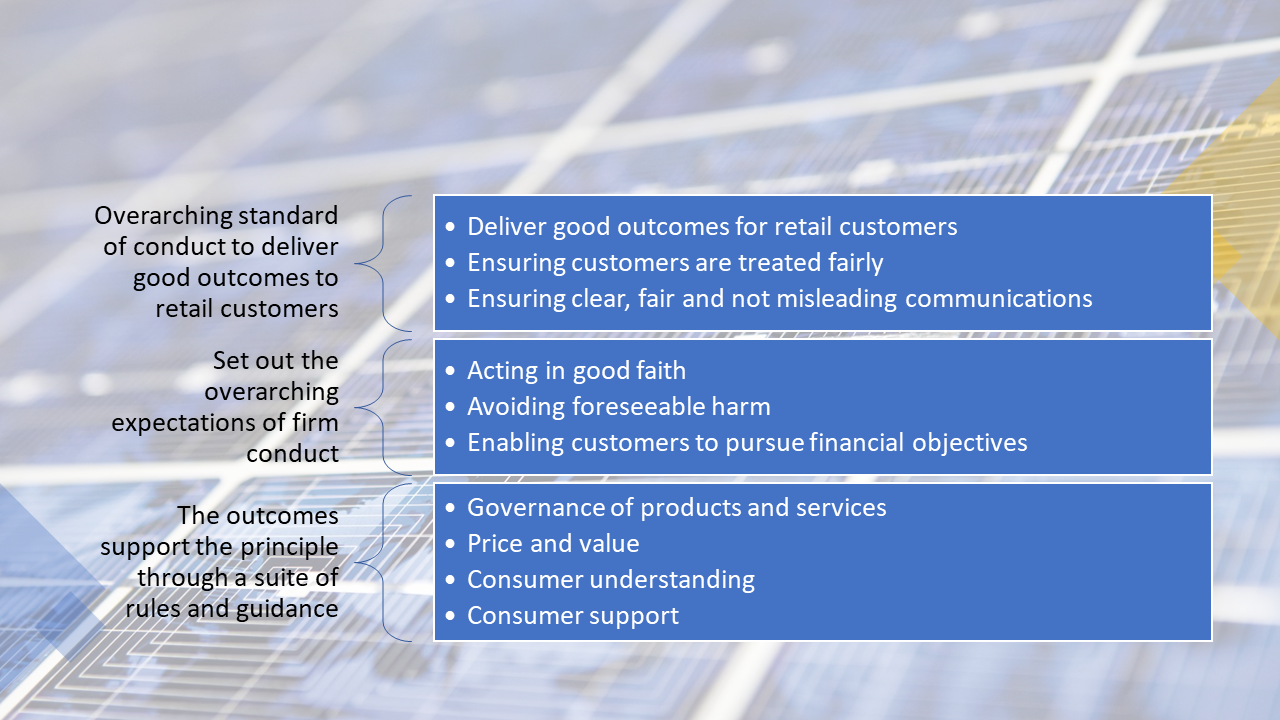

On 27th July 2022, the FCA published new rules and guidance requiring regulated firms “to act to deliver good outcomes for retail customers”. At the heart of the Duty is the intention to ensure the financial services industry works well for its consumers, and that regulated firms understand the needs of their consumers and support them in making effective decisions about their financial affairs.

Consistent with other recent regulation, there is emphasis on prevention of foreseeable harm occurring to consumers, including those identified as vulnerable. In the event that foreseeable harm is caused, firms will be expected to take preventative measures for the future and also go over and above the current redress requirements to the consumers harmed.

This follows two consultation papers issued in 2021 and requires firms to implement the rules for open products and services (those open to new sale or renewal) by end July 2023, and for closed books of business (those no longer on sale) by July 2024. The FCA additionally set interim milestone deadlines for Boards to agree implementation plans by 31 October 2022 and for manufacturers to complete all the necessary reviews on open products and services by April 2023. These rules are required to be implemented by all firms which distribute or manufacture products and/or services to retail and some small and medium enterprise business customers.

What is the impact of the FCA Consumer Duty Regulations?

The expectation is for higher standards of conduct that result in tangible outcomes. There are four specific outcomes that must be evidenced in order to comply the Consumer Duty:

Products and services – are they properly designed for the targeted customers? Firms must consider vulnerability or specific needs for consumers with certain characteristics and must also be able to identify if the potential for harm is increased for these consumers. On an ongoing basis, firms must track if their products and services are performing as expected to meet the needs of consumers in the target markets.

Price and value – is the product or service ‘reasonable’ relative to the benefits? Firms need to look at the overall value delivered to consumers, not just prices, and whether consumers are receiving fair value on an ongoing basis.

Consumer understanding – consumers need to be well informed and able to take responsibility and act on information received from providers. Communications about products and services must be understandable, fair and not misleading. Firms need to evaluate and monitor the impact of its communications to the consumer base to ensure that good outcomes are being achieved.

Consumer support – does the support meet the diverse needs of its consumers, supporting all the way through the entire consumer journey whether through digital or non-digital channels. Firms should consider the best way of engaging with consumers to achieve good outcomes, including providing appropriate channels to meet consumer needs (including the needs of those where more help is required).

Firms need to have a designated Board champion to ensure that the Consumer Duty is raised in all necessary areas and forums, and that the Board is both challenging and engaging in this area. The Board needs to focus as much on customer outcomes as it does on revenue.

So, what is the paradigm shift?

In the past the FCA has focused on input-based regulation. The emphasis for Consumer Duty is towards outcomes-based regulation – in essence, do the products or services meet the needs of people for which they were designed? The Duty puts obligation on firms to demonstrate they meet the diverse needs of their consumer base and that consumers are supported through the entire lifetime as a consumer of a product or service.

How is this enabled and what are the challenges?

This is enabled in part by the availability of data to support analysis of the firm’s products and services as well as monitoring of outcomes from a consumer perspective, providing the firm with the information needed to ensure ‘good’ outcomes are achieved for its consumers, or that rectifying actions can be taken.

The FCA are allowing proportionality of application, although interestingly, the proportionality is aligned to a firm’s current capabilities and resources applied to testing and monitoring of data and information, as well as the size and complexity of the firm and the firm’s role in influencing consumer outcomes. There is a clear expectation that, for example, a firm with mature capability in tracking, monitoring and analysing its sales or revenue information will have in place the same level of capability to monitor its performance in achieving good outcomes for consumers of its products or services.

How should firms prepare for the new FCA Consumer Duty Regulations?

The four required outcomes of the Duty are underpinned by the ability of the firm to capture and analyse information: about its products or services, the characteristics of its consumers, how the products or services are being designed, sold, supported through the distribution chain, how consumers are using the products/services and whether good outcomes are being achieved, and so on. In our view, this requires an holistic view of how a firm is delivering to its consumers, right from the product/service design stage through to marketing and communications, sales, delivery and support. And all this is required throughout the lifetime that the firm delivers the product or service to each consumer. In our experience of working with clients on engagements where there are key dependencies on reviews of business operations, as well as on availability and accessibility of accurate information to enable delivery of the required outcome, the work is often viewed as a ‘big meal,’ with firms increasing their challenges in achieving delivery by starting the required programme activity too late in the day.

Firms need to be prepared

The first deadline has passed: firms should have agreed their implementation plans by the end of October 2022.

Time frames are short: firms must already be acting on a delivery plan to achieve changes and comply by 31 July 2023.

The rules are overarching and will impact all levels of the firm including governance, MI, procedures, service/product design and delivery.

The scale of change will be significant: all retail products and their delivery will need to be reviewed with potential adaption of procedures, data and systems to guarantee the key outcomes.

Implementation is not ‘one-off’: on-going compliance and governance must be assured after the implementation deadlines.

Act now

What actions should Firms take now to comply with the new FCA Consumer Duty Regulations?

Firms must act now and fast to ensure they meet the fast-approaching deadlines:

Ensure the Consumer Duty obligations are understood by the Board, and Senior Management: educate management in the FCA rules set out in the FCA policy statement and ensure the implementation plan will enable the firm to meet them.

Set out the obligations and responsibilities within the Firm: review roles, assign ownership, and define governance aligned to SMCR and organisation.

Define how to demonstrate that products and services to consumers are fair: review all products and services, their impact on consumers that are more vulnerable and define how fair value can be measured and assured.

Define how to measure outcomes and monitor ongoing: review how the outcomes for customers from products and services can be measured and monitored including measures of potential harm.

Implement an action plan to make changes to meet the new rules within the deadline: set out the steps to review the products and services, define the changes needed and track implementation.

What questions should firms be asking themselves following the October deadline for completion of the implementation plan?

The FCA’s deadline for Board approval of the firm’s implementation plan for Consumer Duty has now passed and those responsible for Consumer Duty in the firm should be asking themselves:

Are the obligations under the Duty understood by the Board, and Senior Management of the firm?

Is the Board maintaining oversight of delivery to ensure you will meet the standards required by the Duty and within the deadline?

Have the key risks and dependencies for delivery of the plan been clearly identified and are they being actively managed?

Is the firm able to demonstrate its products and services are fair?

Is the firm’s Champion actively engaged and sponsoring the Consumer Duty requirements appropriately? Is the Consumer Duty embedded in the appropriate governance committees?

How will embedment of the culture change required across the firm be achieved to ensure staff understand their individual responsibility in the context of the Consumer Duty?

Does the firm’s data strategy and implementation plan shape up to the challenge of supporting the Duty to ensure proportionate MI and data are available to demonstrate monitoring of outcomes for consumers is achievable, including measures of potential harm?

And finally…

When the FCA review your firm’s implementation plan, will you be able to demonstrate the required oversight and adequate planning for full implementation of the Duty? Most importantly - can you answer the provocative question of whether your firm puts consumers and good outcomes at the heart of how the business is run? If you are interested in hearing more about how we can help you deliver you Consumer Duty implementation we would love to have a discussion. We can help you get it done with proportionality at the forefront of our minds.